Home » Financial Management » Accounting Office

Bukidnon State University (BukSU) – Accounting Office continued service depends on its ability to safeguard and manage effectively and efficiently public funds (including government and internally generated income) entrusted to it. Central to this goal is a sound structure of financial management and control to maintain both integrity and confidence.

The Accounting Unit is responsible for the following: money out, money in, payroll preparation, reporting and financial controls. Money out – making payments to various suppliers and payroll preparation to make sure that everyone gets paid. Money in – processing incoming payments, Reporting – preparing financial reports, remittances and reconciliation which are submitted to various agencies such as COA, BIR, GSIS, SSS, PhilHealth, BTr, DBM and GAS. Financial Controls – making sure that all transactions are pre-audited to avoid errors and frauds.

Mission

- Establish and communicate policies and procedures necessary to ensure the proper and efficient use of University resources.

- Receive and deposit funds due to the University.

- Maintain and process the University's payroll.

- Ensure the prompt and proper settlement of amounts owed by the University.

- Maintain the University's accounting and financial reporting systems.

- Provide oversight and management to ensure the integrity of all University financial affairs.

- Actively promote and monitor compliance with appropriate Accounting, Auditing, Tax and other rules and regulations.

Quality Objectives

- To provide accurate and timely Financial Accountability Reports in accordance with generally accepted accounting principles in compliance with the government accounting manual and the Philippine Public Sector Accounting Standards.

- To increase awareness on accounting rules and regulations.

Highlights of Best Practices

- The Assessment Section of the unit practices a “No Noon Break Policy” for continuous delivery of services and for catering of more clientele.

Key Accomplishments

- Adheres to an approved Operations Manual.

- Complies with the requirements set by the ISO Internal Quality Audit (IQA) Team.

- Submits and complies with the various requirements set by COA, DBM, CHED and other oversight National Agencies.

The basic requirements applicable to all types of disbursements made by the national government agencies are as follows:

The following are the Reports Regularly Submitted to COA

- Financial Statements for Fund 101; 164 Consolidated, Main, ESC and IGP

- Collection Report

-

Quarterly Budget and Financial Accountability Reports

- Physical Report of Operation (QPRO) - BAR No. 1

- Statement of Appropriations, Allotments, Obligations, Disbursements and Balances (SAAODB)- FAR No. 1;

- Summary of Appropriations, Allotments, Obligations, Disbursements and Balances by Object of Expenditures (SAAODBOE) – FAR No. 1-A;

- List of Allotments and Sub-Allotments (LASA) – FAR No. 1-B; Statement of Approved Budget, Utilizations, Disbursements and Balances (SABUDB) – FAR No. 2;

- Summary of Approved Budget, Utilizations, Disbursements and Balances By Object of Expenditures (SABUDBOE) – FAR No. 2-A;

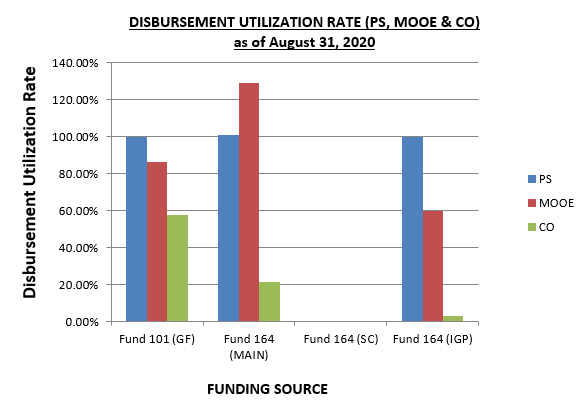

- Monthly Report of Disbursements (MRD) – FAR No. 4,

- Revenue and Other Receipts (QRROR) - FAR No. 5, and

- Physical Reports of Operation

- Statement of Bank Reconciliations

- Report of Salaries and Allowances (ROSA)

- Report on Unliquidated Cash Advances

- Liquidation Reports for Fund 101 and by Cash

- Report of Checks Issued (RCI)

Accounting Team

At the front of I Love BukSU

Team Building

At Finance Building

Awards Night

At Finance Building

Mid Assessment

Previous

Next